Macquarie Arc: Elephants hiding in plain sight

Mining Journal and MiningNews.net have joined forces with resources investment giant Rick Rule and the expert team at Exploration Insights to shine a light on the geology of the foremost frontier jurisdiction for copper mineralisation today – the Macquarie Arc. We analyse the region’s potential to deliver mineral resources at a scale that would make it a material contributor to energy-transition copper needs. And we’ll run the ruler over the current hum of activity being generated by a handful of juniors and exploration technology frontrunners.

Rick moderates this in-depth virtual panel and is joined by Exploration Insights’ Brent Cook; explorers Kincora Copper, Waratah Minerals, Inflection Resources; and subsurface imaging innovator Fleet Space Technologies to devour the detail behind what could soon become the most interesting exploration frontier in the world.

High-Value Tier 1 Promise for Waratah Minerals

Peter Duerden, managing director

Peter Duerden, managing director

ASX-listed Waratah Minerals is focused on developing a high-quality exploration portfolio delivering multiple high-impact discovery opportunities.

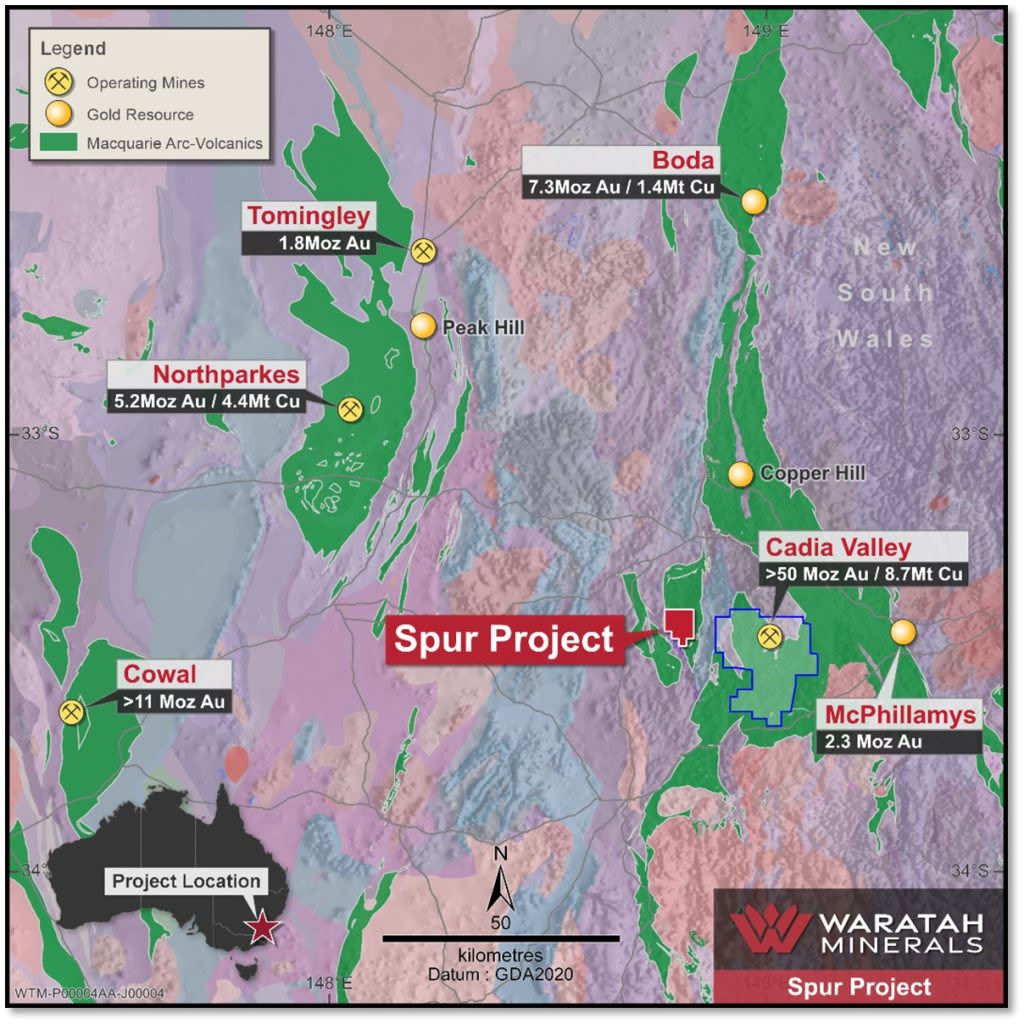

The jewel in Waratah’s crown is its Spur project; an emerging epithermal porphyry gold-copper discovery in New South Wales’ Macquarie Arc. Acquired in January 2024 and situated just 5km from Newmont’s famed Cadia Valley gold mining operation, the asset is brimming with high value Tier 1 promise.

Firm commitments recently received to raise $5 million via a two-tranche placement at $0.25/share mean Waratah can now accelerate drilling activity at Spur, targeting extensions of high-grade mineralisation discovered to date. With the potential for a significant near surface gold resource, several targets are being opened and the RC drilling program is being expanded.

Knowledge is power

Managing director, Peter Duerden brings almost two decades of MacQuarie Arc exploration experience to Waratah Minerals, not least his role in the Boda deposit discovery with Alkane, and at Cadia with Newcrest.

As to the rest of the team, Duerden described the company as “being run by geologists”, viewing the technical bias on the board as affording Waratah an edge when it comes to making discoveries. The rationale is clear: anything that serves to increase those chances of discovery success is at the same time increasing the chances of transforming the value of the company.

Waratah recently partnered with Fleet Space Technologies to undertake an ambient noise tomography (ANT) survey which worked to define additional large intrusive porphyry target zones. Yet, while the company fully embraces such cutting-edge techniques when they demonstrate clear capacity to expedite processes and provide richer insights, it also takes the view that new does not always mean better. Rather, the managing director characterised the overriding Waratah approach to exploration as being about doing traditional geology, geochemistry and geophysics better and faster than before.

Duerden highlighted how the accumulated technical wisdom at Waratah Minerals, as well as nearby Macquarie Arc discoveries at Cowal and Boda have helped to inform the exploration model and targeting strategy at Spur. This has seen efforts directed towards the margins of the main early-stage intrusive complex for wallrock-style epithermal-porphyry mineralisation, while the Waratah team also understand the epithermal sulphide stringers to represent the upper levels of a broader porphyry system.

Near-term value catalysts

As to the current focus of attention and milestones to come, priority targets are being actively drilled at Spur with multiple 100gram metre intercepts now defined. The near-term strategy is to continue drilling to test the extent and the nature of the mineralisation identified to date. That this can be done from surface and will not require deep, expensive drilling under cover means Waratah need not necessarily get into bed with a major to move forward.

Considered highly prospective for epithermal-porphyry gold and copper mineralisation, Peter Duerden asserted that the company’s exploration strategy in respect of its Spur project is consistent and achievable, and that the early signs of a very significant discovery are now emerging.

Inflection Resources exploration powered by AngloGold Ashanti

Alistair Waddell, president and CEO

Alistair Waddell, president and CEO

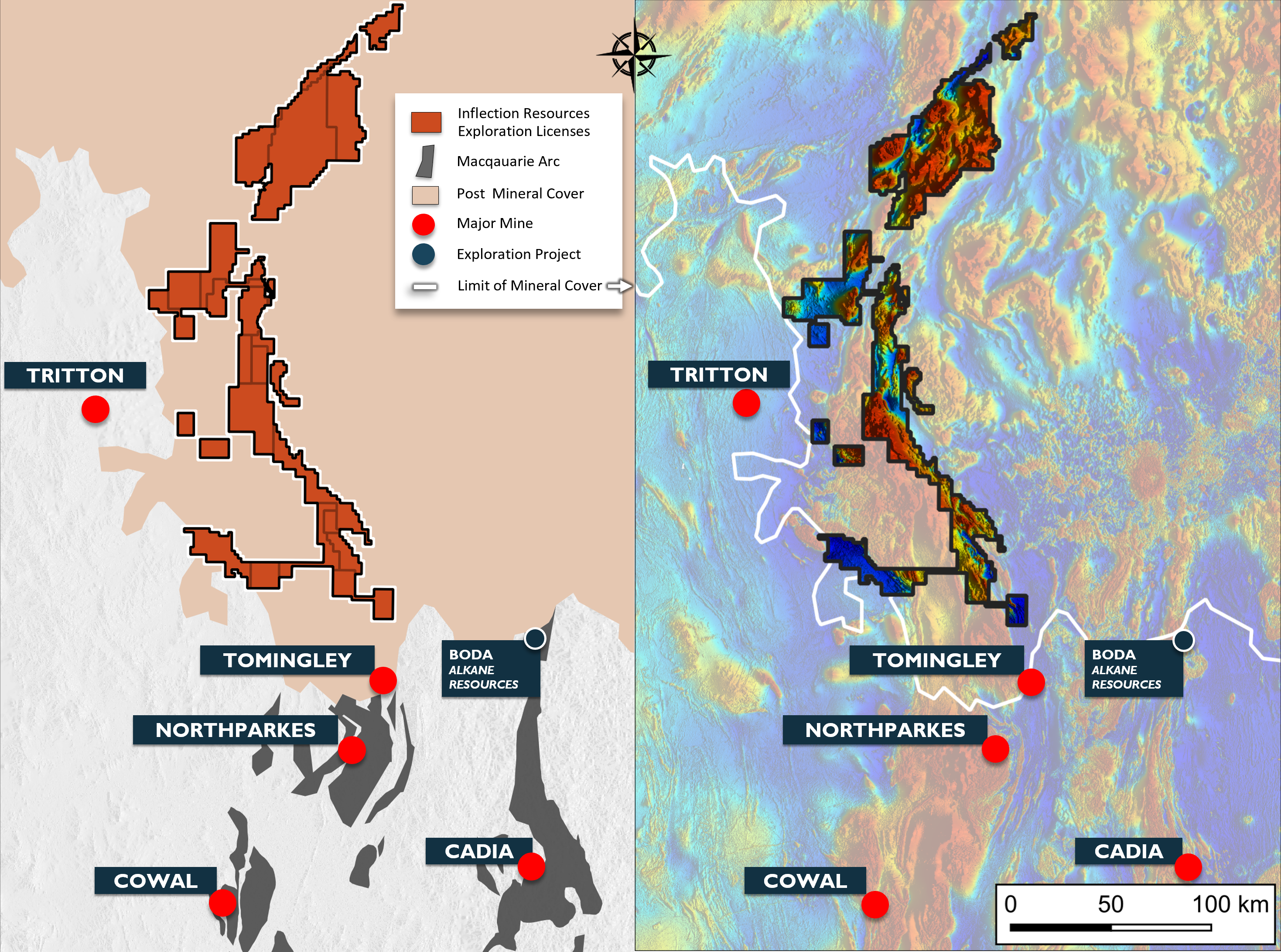

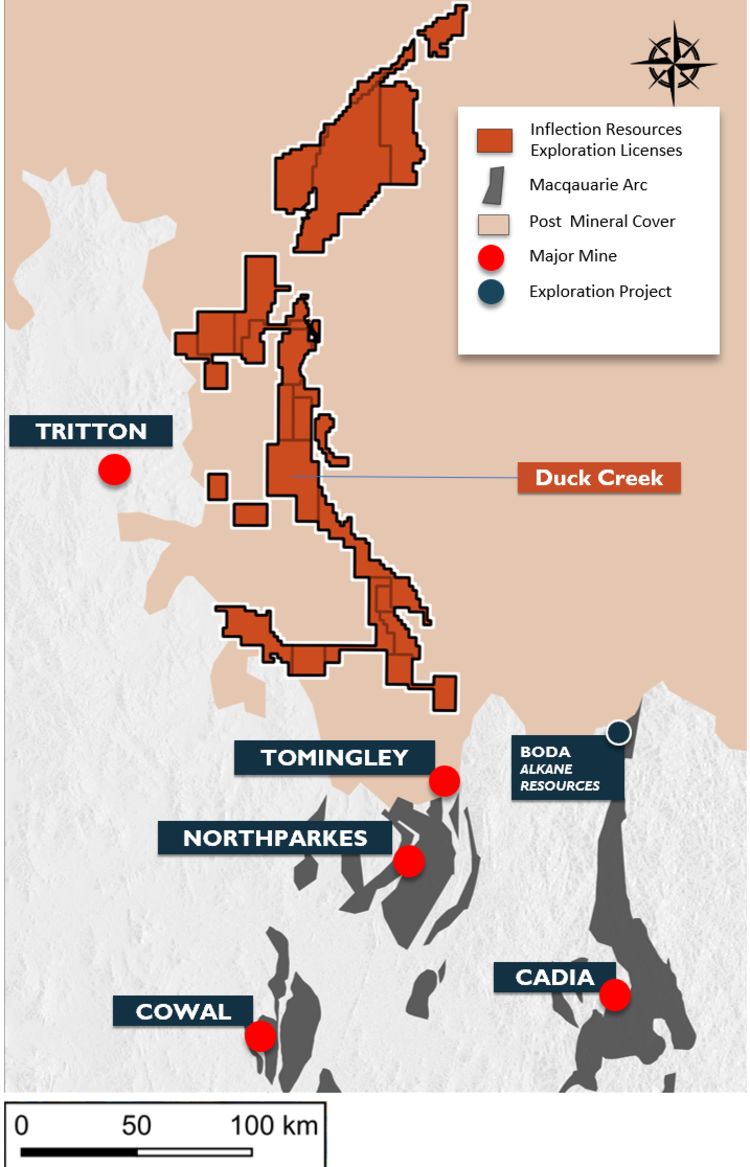

Inflection Resources is the largest owner of exploration licenses in the northern Macquarie Arc, amounting to a district-scale land position of over 7,000 km².

The company is currently aggressively drilling a large portfolio of previously untested targets undercover as part of a comprehensive Phase I drilling programme. This has come in at AU$10m to date; a cost carried entirely by AngloGold Ashanti, with which Inflection has forged a multi-year, large-scale exploration alliance.

Virgin territory

In contrast to the rocks to the south, the northern section of the Macquarie Arc remains largely unexplored, with an approximate 300km north-south trend being under a blanket of post-mineral sediment to varying thicknesses up to 400m.

In 2018, now advisor to Inflection, Dr Douglas Haynes brought his several decades of experience as former chief geoscientist with Western Mining and chief geologist with BHP to bear to analyse and interpret newly available high-resolution airborne-magnetic data covering the region. From this, he identified approximately 35 massive never-before-tested targets he considered analogous to major Macquarie Arc mines located further to the south.

For president and CEO of Inflection Resources, Alistair Waddell, that such an opportunity was open ground, entirely free of claims or exploration licenses constituted a highly compelling rationale for him to get involved, and founded Inflection at that time. Thereafter, the company worked to tie up the entire northern Macquarie Arc district, which provided the foundations to attract a major partner much earlier than would typically be possible for a junior explorer.

Phase I nearing completion

Fast forward to today, and Waddell is focused on the company’s Phase I drilling programme which is nearing completion. This typically sees two to three holes drilled in each target, and if key geochemistry or alteration attributes are not discernible, the team moves on to the next one.

Once Phase I is completed, AngloGold Ashanti reserves the right to select up to five designated projects, with mechanisms in place whereby ever greater financial commitment in respect of each of those individual targets translates to the major receiving a greater share of the pie. To get to 75%, it is required to deliver a pre-feasibility study, which would also see it cede a 1 or 2% royalty back to Inflection.

So promising was exploration work at the Duck Creek project, it has already been designated as a Phase 2 project, and is advancing, courtesy of the AU$7m therefore allocated to it as per the deal terms with AngloGold Ashanti. As a nearology play, it has solid credentials, marked by local magnetic high anomalies truncated by cross arc structures; a setting with strong parallels to proven Macquarie Arc bedfellows, Cadia, Cowal and Boda’s deposits, and also a familiar setting for other global porphyry belts of renown.

All bases covered

Inflection’s multi-year Heads of Agreement with AngloGold Ashanti has acted to de-risk its greenfield exploration by realising the requisite capital to drill test and potentially develop its large portfolio of copper-gold porphyry targets. The deal also has Inflection as the operating party in return for a 10% management fee, meaning no requirement to raise capital to cover corporate overheads in what has been a challenging market.

As to having ‘skin in the game’, the Inflection Resources management team owns 26% of the company. In addition, the company continues to benefit from a very supportive long-term relationship with its core institutional shareholders, Crescat Capital and Resource Capital Funds, both out of Denver.

XLG’s Gilmore Project Unshrouded in Advance of IPO

Clive Donner, executive chairman and managing director

Clive Donner, executive chairman and managing director

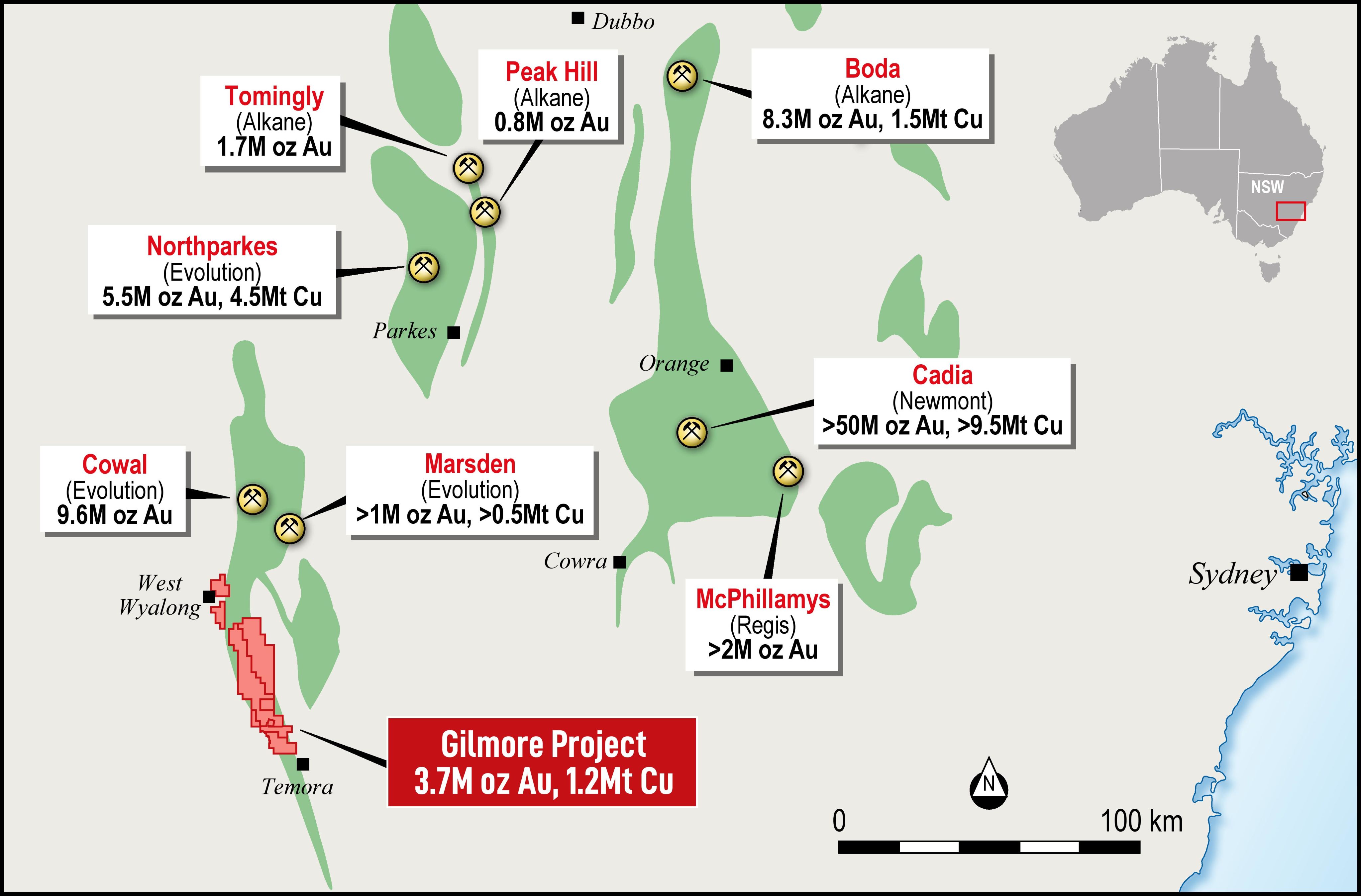

XavierLinQ Pty Ltd’s (XLG) 100% owned large scale copper gold Gilmore project in New South Wales’ Macquarie Arc could accurately be described as a hidden gem.

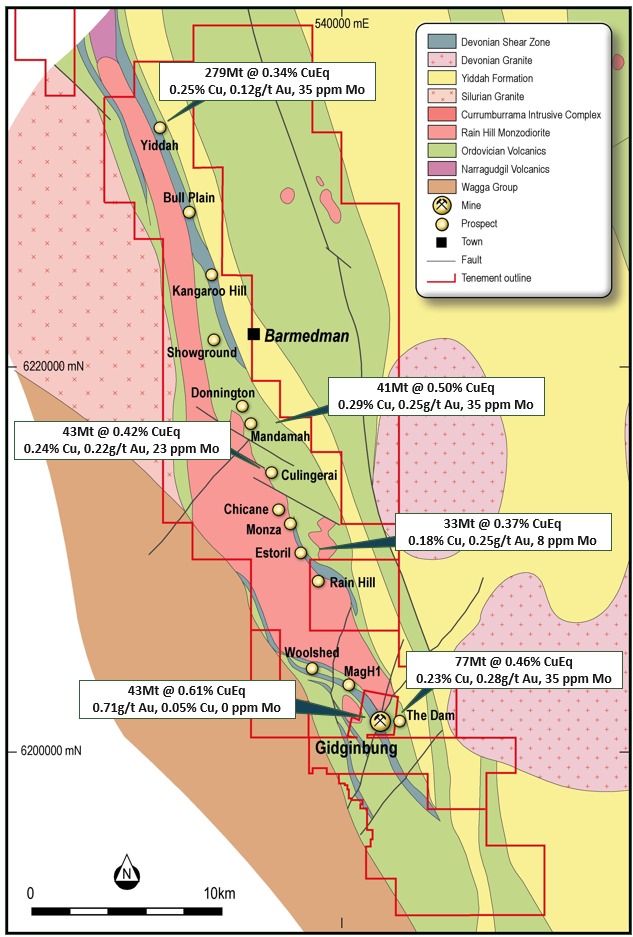

With existing resources of >500Mt containing 8.4Moz AuEq (or 2.1Mt CuEq metal), its potential is measurable and real.

Estimated to a maximum depth of just 300-450m, current resources offer low strip ratios for a simple open pit development, and a strike length of ~40 km identified porphyry and epithermal mineralised systems that remain open in all directions and scalable.

In advance of the anticipated main event, there is the option to develop an initial smaller scale mine in the southern end of the tenements which hosts a current resource base of 120Mt at 0.65g/t AuEq for 2.5Moz AuEq, representing less than a quarter of the current project resource base. More importantly there is potential to mine at a higher grade of 1 g/t AuEq for an initial +10 years which is predominantly gold production with copper credits. Feasibility work is set to kick off soon.

Acquired in mid-2023, XLG’s strategy is to advance the Gilmore project and undertake an accelerated IPO in 1H 2025, offering substantial leverage to both the copper & gold prices, and making XLG a prime candidate for a takeover from a larger company.

For now, the company is working through the database it has inherited, relating to ~470,000m of drilling – readily accessible data that today would take ~$125 million to accumulate.

An eye for winners

Not publicly visible for some four decades, it took someone with an extremely keen eye and the right connections to see past the fragmented tenement ownership to the Cadia & Northparkes porphyry district-type opportunity Gilmore presented.

That person was XLG executive chairman and managing director, Clive Donner, who successfully built and managed two private equity mining funds over 16 years via his private equity company, LinQ Group, which primarily focussed on emerging producers. Prior to this, his 16 years with NM Rothschild Australia and Citibank providing capital and structured finance solutions for mining projects afforded him unrivalled insights into what goes into making a winner.

Moreover, to complement his proven pedigree on the value creation front, Donner has assembled around him at XLG a strong technical team with significant porphyry pedigree and operational execution capability.

XLG tenements

XLG tenements

As Clive Donner put it: “I cannot stress enough how lucky we are to get this package, and how valuable it is to have a 60 km belt and ~600 sq km of tenements peppered with about 25 known deposits, prospects and targets.”

“We have three projects in one company. Our northern, central and southern zones could equally have been divided up and given to three companies to build three separate mines – that’s how big the scale really is,” he added.

The 2023 timing of XLG getting its hands on Gilmore could not have been better, with copper and gold prices having subsequently soared and a much-anticipated major copper supply gap in the offing.

And with Macquarie Arc recognised as a key part of the solution to this clean energy-driven challenge, for those wanting a piece of the exploration action, Donner considers Gilmore to be the most advanced project in the region.

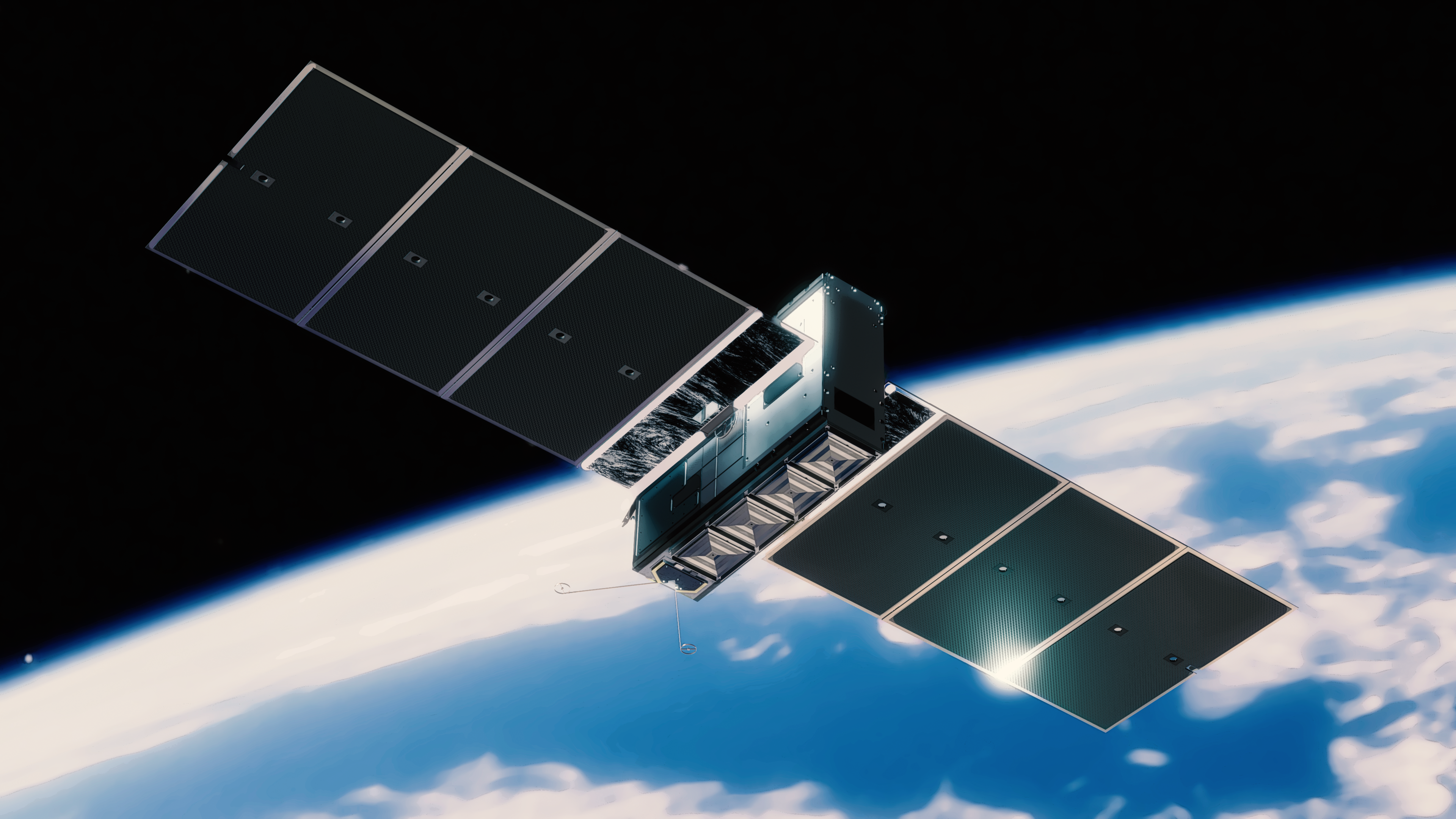

Fleet Space unlocks real-time exploration with space & AI

Fleet Space Technologies delivers real-time and predictive capabilities that are driving faster and more sustainable exploration outcomes at an unprecedented scale.

Australia’s fastest growing company is pioneering the world’s first end-to-end mineral exploration technology – ExoSphere by Fleet® – which integrates Fleet Space’s proprietary satellite network, 3D multiphysics data acquisition, and AI to image mineral systems in real-time up to 5km in depth with near-zero environmental impact.

By combining these advanced technologies into a single end-to-end solution, ExoSphere is rapidly becoming a universal tool used across the industry to bridge long-standing structural gaps in the mining lifecycle that have limited the speed, accuracy, and progress of exploration for minerals needed to achieve net-zero.

End-To-End: Unifying the exploration journey with space and AI

Historically, the data flow between each stage of the exploration journey has been highly fragmented, leading to extended delays between the data acquisition, processing, and decision-making steps of exploration. Onsite teams then face the challenge of interpreting vast and diverse exploration datasets acquired from a variety of different sources and techniques – often taking years or months to analyse and identify targets. The operational complexity, logistics and administrative overhead this produces is a major contributor to why it takes an average of 16.5 years to go from discovery to first production, according to the International Energy Agency.

Fleet Space, however, has designed ExoSphere as a vertically integrated technology stack to enable a seamless progression from data acquisition, processing, interpretation, and targeting, all within the solution’s end-to-end architecture.

This radically streamlines the complexity onsite team’s face at every stage of the exploration journey, while also providing real-time access to 3D and AI-powered targeting insights to narrow their search space and enhance their data-driven decision making. It is no small wonder then that ExoSphere has been rapidly adopted globally, or that Fleet Space has enjoyed exponential growth over the past two years.

Over 40+ leading exploration companies, including big hitters, Rio Tinto, Barrick Gold, and Core Lithium, have used the technology to complete hundreds of surveys for energy transition minerals across five continents. Barrick Gold recently used ExoSphere’s real-time 3D imaging on copper porphyry complexes for multiple zones of interest across 1,150 km2 of their Reko Diq project.

Redefining the Macquarie Arc’s untapped potential

Fleet Space’s execution of the world’s largest real-time ambient noise tomography (ANT) copper survey on over 1800km2 of Inflection Resources licences in the Macquarie Arc was a seminal moment in the history of exploration, demonstrating a hyper-scalable strategy to rapidly advance the geological understanding of Earth’s highly prospective but under-explored regions while minimising environmental impact. ExoSphere has enabled Inflection to identify new high priority targets in support of their Exploration Agreement with AngloGold Ashanti.

By integrating ExoSphere’s industry-leading 3D ANT survey data with advanced multimodal, multiscale AI models, the global exploration value chain faces a tipping point that will drive an exponential reduction in the exploration search space, enhancing data-driven targeting and success rates with more sustainable outcomes at an unprecedented rate. This will redefine the untapped potential of regions like the Macquarie Arc, freeing up resources to be deployed toward opportunities faster, smarter, and more sustainably in a dynamic market environment.

Major backing and proven promise for Magmatic Resources

Adam McKinnon, managing director

Adam McKinnon, managing director

ASX-listed explorer, Magmatic Resources acquired an advanced gold-copper target portfolio in the Macquarie Arc in 2014 from Gold Fields. Today, that portfolio encompasses three advanced projects: Myall, Wellington North, and Parkes.

In 2022, Magmatic made a major discovery of a porphyry copper-gold deposit at Myall, with extensive drilling leading to a maiden resource in 2023 of ~350kt contained Cu-equivalent. This led to Magmatic signing a $14M six-year farm-in and joint venture (JV) agreement with Australian major Fortescue in March 2024 to further explore Myall’s copper-gold potential. In parallel, Fortescue took a 20% cornerstone position in Magmatic.

On taking over the helm in 2022, managing director, Adam McKinnon decided to switch the focus from the well-advanced Wellington North project to Myall, having identified that promising exploration work at the latter had not been fully followed up. This proved to be a smart move with the first hole drilled hitting >700m of mineralisation, something McKinnon described as “pretty exciting.”

An active programme is currently underway at Myall, with Magmatic as the JV operator and Fortescue set to earn up to a 75% interest in the project. Moreover, the financial security now afforded Magmatic by virtue of this development has allowed the company to expand its attentions to its two other projects at Wellington North and Parkes without any loss of focus on Myall.

A rich portfolio

The Wellington North project adjoins and surrounds Australia’s newest gold-copper porphyry discovery at Alkane’s 14.7Moz AuEq Boda/Kaiser complex. Magmatic is actively exploring similar Boda-style targets and can already point to comparable mineralisation intersected. Ergo, investors should know that Wellington North’s promise is not conceptual, and results from further exploration to come will be eagerly anticipated.

Further to the west, Magmatic’s Parkes Project is characterised by a recently defined six-kilometre copper trend with outcropping mineralisation. The prospect has had little modern exploration and with a large induced polarisation (IP) survey having just kicked off, its potential is clear, representing what McKinnon described as “an incredible opportunity”.

Yet, given the scale of what has already been discovered, of the three Magmatic projects across the Macquarie Arc, it is Myall that possesses the Tier 1 ingredients to really excite the market. And with it, the potential to provide Magmatic Resources with what McKinnon describes as “a transformational opportunity for the Company.”

As McKinnon explained, the key to Myall is the very large-scale potential of the project, offering up even at this early stage a huge resource still open in every direction.

Magmatic has demonstrated that Myall has the same age rocks, the same style of mineralisation and similar scale intrusive complexes as the decades-long established Northparkes mine just 50km to its south, now majority owned by Evolution Mining. It also shares similar geological credentials to Newmont’s famed Cadia deposit nearby, with that mine representing one of Australia's largest gold and copper mining operations. This should all be reassuring and inspiring music to the ears of shareholders both current and prospective.

Rome wasn’t built in a day

The managing director further highlighted that Northparkes was not all discovered in one hit and that over a 40+ year period no less than 22 individual porphyries have been discovered at the project. With Myall enjoying so many geological parallels, he was making the point that while he believes there is lots more to find, uncovering these deposits is somewhat of a process.

Similarly, Wellington North is hosted in the same package of rocks as Alkane’s Boda deposit, and it has already demonstrated porphyry mineralisation at numerous areas across the tenement. Exploration work to date should just be seen as the beginning of the process, with good reason to think that Boda-type endowment and broader scale potential are around the corner, given that early-stage results are comparable.

"In terms of geological provenance, you won't find a better area for this exploration." Adam McKinnon

Next steps

Looking forward, at Myall, Magmatic is currently engaged in an extensive historic core resampling program to provide essential geochemical vectoring data. This will feed into an upcoming drilling program that will include six relatively deep diamond holes into the deposit by the end of 2024. These holes are planned for the greater Corvette-Kinswood area, which has produced many significant copper and gold intersections over the last two years.

At Wellington North, Magmatic has programmes coming up that will test three key porphyry targets at various states of progress, which will include drilling at the promising Rose Hill site.

At Parkes it’s all about the newest discovery, Black Ridge, where an IP survey is currently underway, with further mapping and sampling set to take place to advance the project.

And in terms of being well positioned for making further discoveries, McKinnon takes pride in Magmatic’s active exploration credentials, asserting that the company “puts more money into the ground than just about any other junior in our area.”

Foundations in place. Inflection point reached

Sam Spring, president and chief executive

Sam Spring, president and chief executive

Kincora Copper’s attentions are focused on its district scale 4000 sq km landholding and scaleable drill ready targets in New South Wales’ Macquarie Arc, one of the most significant gold rich porphyry regions in the world.

This leading listed pure play explorer’s efforts are informed by its hybrid business model of doing deals and making discoveries.

Kincora Copper’s 100%-owned Australian projects are already benefitting from multiple deals made over the last 12 months that has led to A$60m of multi-year partner funding. In addition, the company can point to a technical team with world-class copper and gold discovery pedigree and ‘skin in the game’ equity ownership, backed by a consolidated and a sophisticated shareholder register.

President and chief executive, Sam Spring singled out John Holliday as a key figure on the Kincora Copper technical team, given his unrivalled knowledge of and record of success in the region stretching back 45 years. Having been the principal originator, discoverer and site manager for the Tier 1 Cadia gold-copper porphyry and the Marsden copper gold porphyry deposits in the Lachlan Fold Belt in which both the Macquarie Arc and Cobar Superbasin sit, Kincora Copper’s technical committee chair could be considered a byword for success.

Kincora Copper’s future fortunes have been given a further major boost by link-ups with Earth AI, Fleet Space Technologies, and a joint venture with a subsidiary of AngloGold Ashanti; partnerships serving to bring expertise, credibility and financial security to the company’s offer.

The collaboration with Fleet Space has allowed for the deployment of ambient noise tomography (ANT) and gravity geophysical surveys at Kincora’s Nyngan Project to complement near term drilling. Meanwhile the partnership with Earth AI has seen its refined artificial intelligence model and field-based exploration generate a pipeline of new intrusion related copper targets at Kincora’s Cundumbul project that are currently being drilled. This affords shareholders exposure to a fully funded, new discovery focused opportunity.

For its part, AngloGold Ashanti brings significant greenfield exploration pedigree and major financial muscle to Kincora’s table, allowing the company to drill test a wide range of large intrusive-related copper-gold targets on its property, which includes two of the last remaining virtually untested, volcano-intrusive complexes.

For these parties, the rationale for partnering with Kincora Copper is clear, given it holds district scale positions within highly prospective settings on proven mineral/mining belts in a tier one location that is seeing multi-billion dollar M&A and investment. For Kincora, put simply, these link-ups have significantly increased its chances of discovery success.

Sam Spring is confident that such developments will act to unlock and realise significant asset level value. While noting that, “it takes years of building foundations to be an overnight success”, with all ducks now in a row, so should follow the news flow and results to drive that value.

That Kincora Copper is ready to put its message out there is testament to those foundations having been firmly embedded. And for investors keen to secure a slice of the Macquarie Arc action at the right time, the company now demands closer investigation at what constitutes a very interesting inflection point with drilling activities ramping up, further new projects and deals proposed and providing multiple potential share price catalysts.